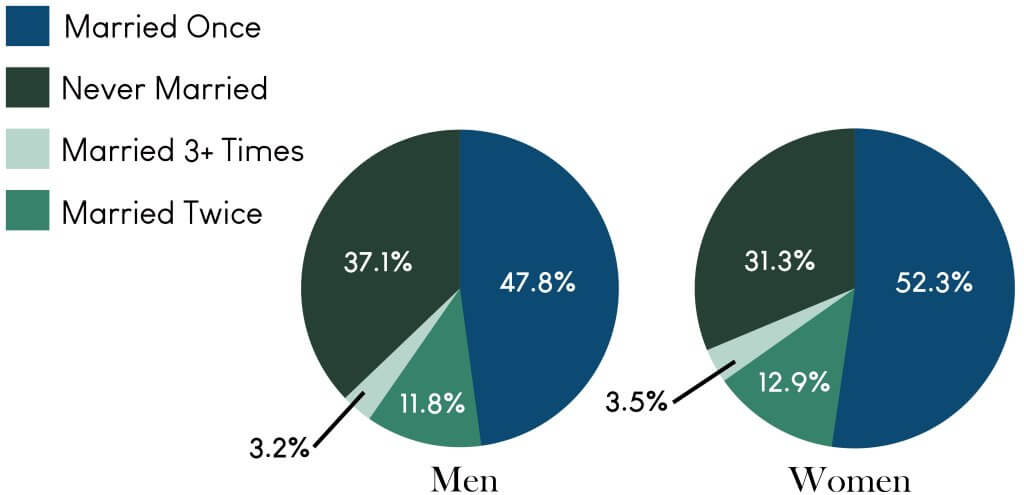

2 out of 3 Americans ages 15 and older have been married at least once. Surprisingly, a substantial number have also been married more than once. When two families come together, it can be difficult to navigate the financial landscape. Whether it’s your first or fifth marriage, the challenge remains. In today’s blog, we have gathered a few financial tips for blended families.

Source: U.S. Census Bureau, 2022 (2021 data)

Air Out Your Dirty Laundry

It is good practice to disclose all your finances to your partner. Try not to be defensive or embarrassed, but instead, focus on the fact that you are being open and honest with them. You should disclose all assets, income, and debts to decide how these items will be managed as a combined family.

Consider a Prenup

Do not assume your partner loves you any less by requesting a prenuptial agreement. A prenup can help couples avoid bitterness or misunderstandings if the marriage were to end in divorce or the death of a spouse. If you don’t want a prenup, discuss your concerns with your partner openly and honestly. You can always adjust after you’ve said, “I do”.

To Cohabitate or Not to Cohabitate

Most couples in their second marriage often say that moving into a new home gives them a feeling of a fresh start.1 You may find that sharing a residence can be more convenient. If you move into a residence one of you already owns, you may be better off financially.

3 questions to ask your spouse about short-term and long-term finances:

- Will we combine bank accounts or keep separate accounts? What about a joint account to share expenses?

- What accounts will our paychecks be deposited on?

- Will you help me pay off my debt? (Student loans, auto loans credit cards)

Remarried couples are generally happier when they collaborate financially.2 There is no right or wrong way to do it.

Honey, What About the Kids?

Remarried couples should discuss how financial responsibility will be handled for kids from a previous marriage and the kids they have together. Becoming a stepparent or a divorced parent can be emotionally difficult. Consider the following:

- Be clear about alimony payments, child support, and other financial responsibilities.

- What are your intentions or legal obligations to paying college tuition for the kids from a previous marriage?

- Are there any assets you want to reserve for your children? Will your spouse be willing to waive rights to those assets?

- Communicate and plan with your ex-spouse if you share custody of the children.

- Be sure to understand and agree on financial issues. For example, who will claim the kids as a beneficiary on tax returns? Who is the custodial parent for future financial aid applications?

Note: a beneficiary deduction may be better for the parent with the highest earnings. The custodial parent with lower earnings may be better for helping a student qualify for financial aid.

Updating Wills and Beneficiary Forms

Your will and beneficiary forms accurately reflect your current wishes and situation. A will can help distribute assets during probate and identify heirs, but some assets such as pension plans, qualified retirement accounts, and life insurance policies are given directly to the beneficiaries named on the forms.

These assets bypass probate and may have different beneficiaries than those specified in your will. ERISA-governed retirement accounts like 401(k) plans require your current spouse to be the primary beneficiary by law. To name beneficiaries from a previous marriage or your ex-spouse, you will need a notarized waiver from your current spouse.

Blending families can pose several challenges, especially on a personal level. However, handling financial matters can be easier if you take the necessary steps to identify the issues and establish shared financial goals.

(1–2) American Psychological Association, August 23, 2019 (most current information available)